We are expanding the portfolio of our TV channels and we are acquiring broadcasting rights to attractive sports events

We are expanding the portfolio of our TV channels and we are acquiring broadcasting rights to attractive sports events

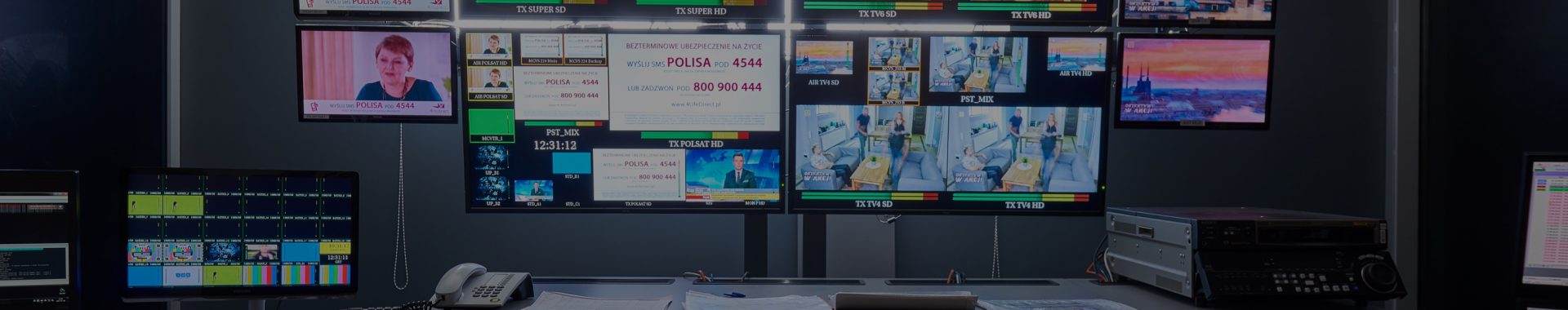

In 2017, the Group added new TV channels to its portfolio. The new channels include a general digital terrestrial TV channel, called Super Polsat, which broadcasts entertainment and news programs as well as movies, TV series and live sports coverage, and also the thematic channel Polsat Doku HD, whose offer includes a wide range of the best, premiere documentary productions on various topics from around the world dedicated to the entire family. In addition, by acquiring five music stations, namely Eska TV, Eska TV Extra, Eska Rock TV, Polo TV and VOX MUSIC TV, as well as by establishing cooperation with Fokus TV and Nowa TV, we strengthened the Group’s position in the segment of thematic channels whose importance has been continuously growing on the Polish TV market. Thanks to our established market position and solid vierwership results, the new channels have formed an attractive addition to our comprehensive programming offer.

One of the assumptions of our mission has constantly been to provide to our viewers the most attractive content and the best entertainment. Bearing this in mind, we have decided to make a strategic investment in exclusive broadcasting rights to over 1000 UEFA Champions League and UEFA Europe League matches over the next three years (from 2018 to 2021) in all distribution channels, including TV, the Internet and mobile devices. TV Polsat Group’s channels will broadcast the first Champions League matches already in September of 2018.

What is more, by virtue of the agreement signed with FIVB, during the coming 7 years TV Polsat channels will be broadcasting major international volleyball events.

Thanks to the investments in attractive content as well as strict cost control we have been able to maintain a strong position on the Polish TV broadcasting and production market. We estimate that in 2017 we acquired a 27.2% share in the Polish TV advertising market worth approximately PLN 4.1 billion. POLSAT, the Group’s main channel, acquired a 12.3% audience share, while our thematic channels had a 12.1% audience share.

We systematically develop our multiplay offer for homes and businesses

In 2017, we consistently developed our offer of multiplay services. We promote the smartDOM and smartFIRMA unique savings programs which enable our customers to create favorable combinations of state-of-the-art services for homes and businesses. Our offer of integrated services relies on a simple and flexible mechanism – it is enough to have only one service to be able to obtain attractive discounts for the entire duration of a contract by buying further products from us. Our customers can flexibly combine such products as satellite TV, LTE broadband access, telephone services, banking and insurance services, electricity and gas supply, home security services or the purchase of electronic equipment, obtaining savings on each service they add.

THE GROUP’S OPERATING PERFORMANCE

The consistent pursuit of our strategic assumptions during the year 2017 has been reflected in very good operating results of both of our business segments.

Stable contract customer base

In accordance with our strategic assumptions, we focus on strengthening the loyalty of our customers, in particular by offering an extensive portfolio of integrated services as well as by building the ARPU of our contract customers. We have a stable base of contract customers which numbered around 5.8 million at the end of 2017.

Stable growth of contract services

At the end of 2017 contract services accounted for a vast majority (83%) of the services we offer. Their number increased by 3.2% yoy and reached 13.7 million. We observed growth of the number of all services provided in the contract model: pay TV – by 3.7% yoy, to 4.9 million, mobile telephony – by 3% yoy, to 6.9 million, broadband Internet access – by 3% yoy, to 1.8 million. In 2017, growth in this segment was significantly driven by the growing popularity of the Multiroom service, the dynamically growing sale of paid OTT services as well as the effective implementation of the upselling strategy which was reflected in the rapidly growing base of mobile telephony users.

At the end of 2017 we provided a total of over 16.5 million services (RGUs) in both, contract and prepaid models.

Success of our multiplay strategy

We strive to maximize average revenue per contract customer by upselling products and services to the combined customer base of Cyfrowy Polsat and Polkomtel, among others as part of the smartDOM loyalty scheme. Our integrated services offer enjoys constant interest and continues to record very good sales results, which has a positive influence on the level of RGU per customer, ARPU of our contract customers as well as the churn ratio. At the end of 2017 our integrated offer was used by over 1.5 million customers who had over 4.5 million services (RGUs). This meant that as many as 26% of our contract customers had chosen our integrated services offer.

The success of our multiplay strategy translated into stable ARPU in the contract segment, in spite of the substantial adverse impact of the implemented Roam Like at Home regulation, as well as into systematically growing loyalty of our customers.

In the year 2017 the average revenue per contract customer of our Group was at the level of PLN 89.0, demonstrating slight growth year-on-year. The high level of subscriber satisfaction with the provided services was in turn reflected by the low churn ratio. In 2017, we recorded churn at the level of a mere 8.8% annually, which is one of the best results in the industry.

Changes on the prepaid market

During 2017 the Polish prepaid mobile services market remained under the pressure of external regulations. The reduction of our prepaid base by 15.3% was above all associated with the statutory obligation to register new prepaid SIM cards, which came into effect in July 2016. The regulation led to a market-wide significant drop in new activations and also forced mobile operators to deactivate in February 2017, those SIM cards which had not been correctly registered by that time. Concurrently, as a result of this regulation, prepaid ARPU increased in 2017 by 7% yoy and reached PLN 19.9, which was the outcome of cleansing the prepaid SIM base of cards which were characterized by short-term usage only, thus consequently by low ARPU.